For Allocation, Review & Re-Balancing Decisions.

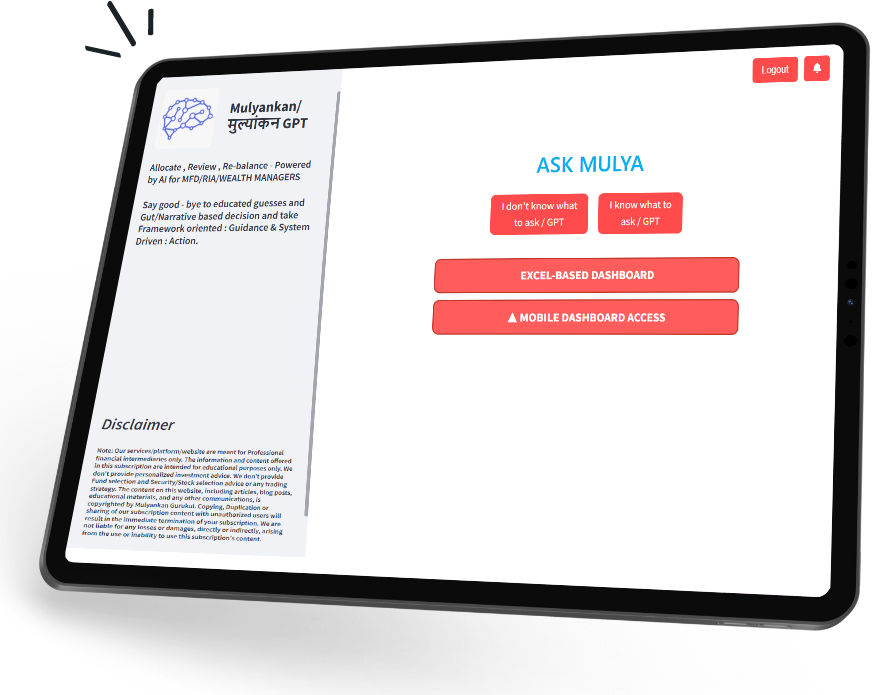

Custom-Made AI

✧ 99.9 % Probability that you will out-perform competition,

✧ by saying Good-bye : to guesswork, Narrative based decisions and

✧ by adopting : Structured framework and robust system.

99.9% Probability to Improve Allocation Outcomes across investor profiles On Both Fronts:

99.9% Probability to Improve Allocation Outcomes across investor profiles On Both Fronts:

✧ 99.9 % Probability that you will out-perform competition,

✧ by saying Good-bye : to guesswork, Narrative based decisions and

✧ by adopting : Structured framework and robust system.

Covered 27 Cities: On-Ground

In-person sessions on Valuation Math & Data Science for Capital Allocation

Trusted by 1300+ Users Across India

Includes MFDs / RIAs · Family Wealth Offices · AMC Personnel’s · Brokers

Covered Members of India Renowned Advisor Association

And Joint Exercises with AMC for Awareness and Professional Development of Partners.

Our Platform Recognized for Its Merit and Value

Featured & Covered by: WealthForum · CafeMutual

Foundational Demo Video

- ◈ Platform Overview

- ◈ Why Band theory of Valuation based on Past data don’t work

- ◈ ABC of Data-Science scores

- ◈ Using Scores as Validation tool for Capital Deployment Decision and if required, when to re-balance

- ◈ Quick Menu Navigation for : Capital Deployment Strategy building.

- ◈ Quick Menu Navigation for : MF filtration , Style/Factor Selection and Rotation , Stock Distilled score and Filtration

Subscribe Us for Platform access.

Mulyankan Grid : Indias one of its kind of Technology services for Financial intermediaries/Institutions where Platform is built and setup under your Banner. Under your Hosting. Create Login IDs for Client, Sales/Research team and Sub-broker.

Our Differentiation

Mulyankan Grid

Framework Working Methodology

& Platform Key utility 👇

No to Band Theory based on Past Data!

Static Valuation bands just don’t work.

No to Band Theory based on Past Data!

Static Valuation bands just don’t work.

Our Data Science - Driven Approach

Based on 20 + advanced metrics from Valuation, Earnings & Interest rate cycles, Our system calculate 50 + Scores to evaluate Asset class and Category standing.

Our Data Science - Driven Approach

Based on 20 + advanced metrics from Valuation, Earnings & Interest rate cycles, Our system calculate 50 + Scores to evaluate Asset class and Category standing.

Based On Above Scores + Advisor Input on Investor Profile :

1. Get a Straight-Forward Validation Tool on :

- How to Buy : When to go for Lumsum , When to Run STP or STOP STP.

- Where & How Much : Which Asset Class + Category within that Asset class and How much to Over-weight / Under-weight / Sell or Avoid.

- Short-term Tactical Calls : On Sectoral and Global Market

- Style / Factors Selection : Allocation % , When to Exit or Rotate any Style.

2. Build Capital Deployment Strategy for :

- Fresh Purchase,

- SIP,

- Income Withdrawal / SWP and

- Debt Investment

3. Tool is trained to cater both : Non – Rebalancing and Re-balancing practice.

- Those who Looking For No-rebalancing or focus to reduce Tax-outgo: System guide on How to Buy , where & how much on basis of Favourable zone of Category. Guidance on when to avoid and follow staggered approach during un-favourable zone.

- Those who Looking for Re-balancing : Gives guidance on un-favourable zone too for reducing position/risk.

2 Kind of Re-balancing frequency :

Minimalistic & Regular.

Following Execution Assistance Available

Fund

Style

Stock

Pricing and Plan

Basic

Excluding GST for 36 Months

- Core Allocation Dashboards ☑️

- Marina (Style Selection Dashboard) ☑️

- Mulyankan GPT ☑️

- Satelite Allocation Workbook ☑️

- Mobile Based Dashboard ❌

- Future Upgradation ❌

Premium

Excluding GST for 36 Months

- Core Allocation Dashboards ☑️

- Marina (Style Selection Dashboard) ☑️

- Mulyankan GPT ☑️

- Satelite Allocation Workbook ☑️

- Mobile Based Dashboard ☑️

- Future Upgradation + New Features at Zero Cost ☑️

Mulyankan Grid

Excluding GST for 36 Months

Custom Setup under your Banner

- No Subscription ☑️

- No Co-Branding ☑️

- No API ☑️

- Own entire platform under your Banner ☑️

- Under your Website Hosting ☑️

- Create Unlimited Login ID's for Sales team, Sub-broker and Investors ☑️

Mulyankan Grid Launch your own platform

India's One of its kind of Technology services for Financial intermediaries/Institutions.

Set-up Requisition Form:

Don’t Subscribe. No Co-branding.

Own India’s most Structured Framework & Research System ever made

Backed by Data Science – under your own Banner and Website Hosting

Create unlimited Login IDs for : 👥 Sales Team; Sub-Brokers ; Clients

Scale AUM Rapidly

Offer strategic scores & insights.

Loyalty Builder & retention tool for existing clients.

Convert prospects faster and Give Wow Experience with Powerful first impression.

Terms & Conditions

The content on this website, including articles, blog posts, educational materials, and any other communications, is copyrighted by Mulyankan Gurukul. By subscribing to the Analytics service and platform, you acknowledge and accept the following terms and conditions:

Mulyankan Gurukul is not a registered mutual fund distributor or investment adviser under SEBI regulations.

Please note that the content provided on this platform does not constitute personalized investment advice or recommendations.

You agree to use the provided information responsibly and at your own discretion.

Copying, duplicating, or sharing our subscription content with unauthorized users will result in the immediate termination of your subscription.

The information and content offered in this subscription are intended for educational purposes only. We strive to ensure accuracy and up-to-date information; however, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the subscription’s content. Your reliance on such information is solely at your own risk.

We are not liable for any losses or damages, direct or indirect, arising from the use or inability to use the content provided in this subscription.

By accessing and using the content provided by Mulyankan Gurukul, you agree to abide by these terms and conditions. Thank you for understanding and adhering to these guidelines.

All the trademarks, logos and service marks, information and content provided on the Website is the proprietary, confidential property of the Website.